Do you have a fantastic idea for a product or business? Are you thinking of starting a business? It’s possible that this moment in your life is the most thrilling one.

Market research for startups can provide the answers to the frequent queries that are on your mind. There are probably some doubts that are working against the enthusiasm and promise of your startup business plan.

What is market research?

In simple terms, market research is the act of gathering data on a business, market, service, product, or issue in order to use that information to support data-driven decision-making (DDM).

There are numerous forms and sizes for market research. Both qualitative and quantitative research are regarded as primary research, and they are the two highest-level pathways.

Let’s discuss the difference between qualitative and quantitative research,before we go on to primary versus secondary research.

- Qualitative research

Exploration of subjects and ideas is the goal of qualitative research, which is non-scientific. This could involve six people in a focus group or ten prospective consumers in-depth phone interviews.

While speaking with six to ten individuals will be quite informative and provide you a lot of material to think about, it won’t be statistically reliable.

Six people you talk with will never, ever represent millions of potential clients.

It’s important to realize that exploratory research is what qualitative research is all about. You can go deep, but the results shouldn’t be applied widely to big audiences.

- Quantitative research

Qualitative research is not the same as quantitative research. In order to produce accurate and statistically significant information, statistics and numbers are used.

Numerous popular methods of quantitative research are available, such as 400-respondent online surveys, phone surveys, in-person intercept surveys, etc.If you want to gauge the feasibility of your startup, this is crucial.

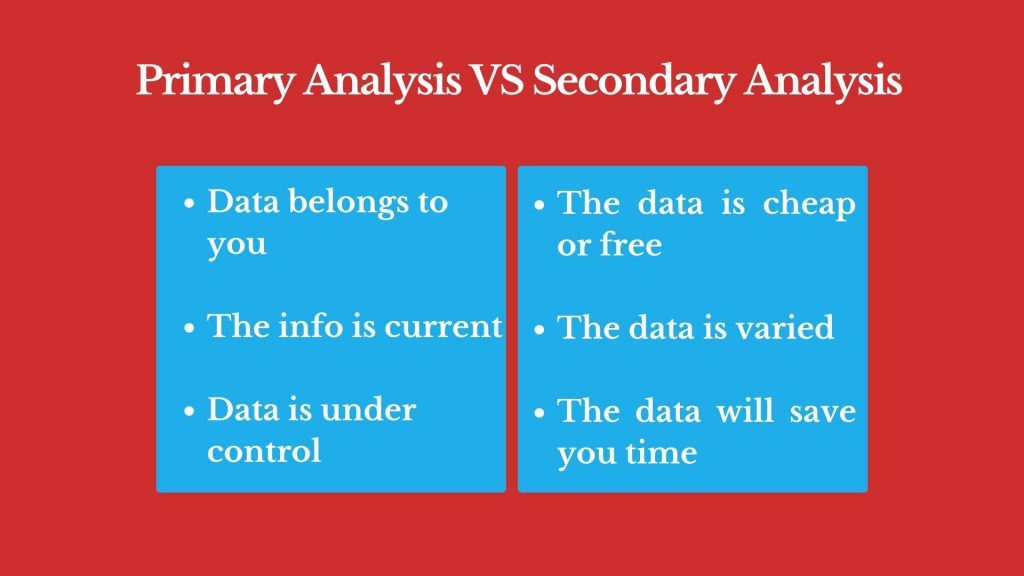

Primary vs. Secondary Market Research

Which is superior to the other?

Not invariably. However, as we previously discussed, both primary and secondary research have distinct functions. We’ll go over the main distinctions and advantages of each approach below.

Primary market analysis

The data you gather for primary research is your own or custom data. Numerous of the approaches we covered before apply here, including focus groups, online polls, intercept surveys, and more.

Top advantages of primary research consist of:

- Data belongs to you

Since you carried out the research, it is yours. For your brand, this is an excellent opportunity for benchmarking. To expand, you must be able to operate with a consistent record of important facts.

- The info is current.

Sadly, well-researched studies from years past with excellent data don’t hold up. Primary research yields fresh, trustworthy data.

- Data is under control.

The data and full research procedure are guaranteed to be customized to your demands by primary research. You are not dependent on other people.

Secondary market research

There is secondary research in addition to main research. Data that has already been gathered is used in secondary research to aid in decision-making.

This could include information from the Census, customer databases, data access through paid subscription services, Google searches to retrieve previous reports and information on a certain subject, etc.

Top advantages of secondary research consist of:

- The data is cheap or free.

The information gleaned from secondary research is frequently inexpensive or free.

- The data is varied

On a myriad of subjects, secondary data sources exist. There’s probably secondary research available on whatever your organization requires data for. For specialized subjects, this isn’t always the case, though.

- The data will save you time

Conducting research on a topic where you know there is already new data is illogical. You still receive accurate data while saving time and money.

Why Does a Startup Need Market Research?

In addition to wanting to know how to conduct market research for startup, you might also want to know if market research is required to test a new service, product, or company idea.

An extensive range of advantages can be obtained from conducting market research. The capacity to reuse the data across other departments, assets, and users is the main theme of these benefits.

- Aids in the creation of concepts

Do you know the basic concept of your offering but not all the specifics?

A startup can benefit from market research in a number of areas related to your concept:

- What ought I to call it?

- Which logo ought I to select?

- Which aspects of the concept should I present?

- Which characteristics are not crucial?

- How compelling is the idea for the new product?

- Is it distinct or different?

- Would you think about buying it? If not, why not?

Furthermore, testing is still important after these initial phases. View our comprehensive guide to ad concept testing surveys to learn how to utilize them to promote your startup’s campaigns in the future.

- Marketing insights

Do you need to learn more about the messaging you should employ in your marketing campaigns or what factors influence potential customers the most when they are deciding whether or not to purchase your goods or services?

You can create a marketing strategy for startups with the aid of market research, which can help you determine which source(s) to use for advertising in order to reach your target demographic.

You may wish to test the layout of your homepage while you are still constructing your website. You could be considering running advertisements on social media. Or perhaps you want to place an advertisement in a magazine.

To make sure you are headed in the correct direction and using message and imagery that appeals to your target audience, you can test these using parts of the design of your market research project.

Finding out how essential elements are to you when making a purchase is one of the most frequent questions asked in product concept development surveys.

You can enquire about the significance of any feature or advantage of your startup idea, including cost, customer service, shipping time, experience, hours, and variety.

You now have the three things you need to highlight in your marketing if the survey revealed that your target audience is only concerned with three things: online payment, customer service, and shopping time. They turn into your primary messaging.

- Technique

Although this is a more general advantage, market research will help you decide on more important aspects of your firm. Gaining an understanding of the fundamentals of your business plans is also necessary to conduct effective market research.

- Does your startup need to switch from an in-store to an online retail model?

- Does accommodating evening clients require me to alter my business hours?

- Which market has the most potential, and where should my business be located?

You may get guidance from market research on all of these more strategic topics.

- Creating a profile of your ideal client

Describe a consumer persona, please.

You can obtain a wealth of information about your target client with only a small survey. The poll may reveal that the ideal buyer is a woman in her 30s to 40s with children living at home and a family income of $100,000 or more.

This information helps your marketing initiatives and advertising budget by avoiding the waste of money on less profitable audiences.

There are countless data points available for client profiling:

- Demographics (such as age, gender, marital status, number of children, income, and ethnicity)

- The actions (used competitors, frequency, type, and purpose of purchases, etc.)

- Attitudes (perceptions of brands, sentiments that lead to purchases, etc.)

- Geographical (ZIPS, counties, DMAs, states, regions, and countries) (where your audience resides/works)

- Selecting an appropriate market

If your business is a physical site (restaurant, bookshop, etc.), you’re undoubtedly pondering where would be the ideal location to open.

You can determine which part of your location has the greatest buying potential with the aid of market research. This might be done with a straightforward poll that distributes results among six counties.

If you ask just how appealing your idea is, or how likely it is to be purchased, you might discover that one of those six counties is much more likely to buy your startup than the other five put together.

- Selecting a fair price

You may be wondering, “How much does market research cost?” It varies.

One of the most popular reasons to commission market research is to understand price points.

This holds true for Fortune 50 firms as well as startup research brands. What price range would someone be ready to accept for the good or service? Pricing in market research can be approached in a variety of ways using systematic techniques.

Sadly, it is not possible to find out a respondent’s willingness to pay with an open-ended question. Astute survey participants frequently see it as a lowball value negotiation session.

Whichever strategy works best for you—the Van Westendorp procedure or the Gabor-Granger model—a market research firm like Drive Research can help. Every one of them has a methodical approach to determining the ideal price for your firm.

- Investing in and receiving financing for the research

Venture capitalists frequently need data before granting you funds to support your firm, as their goal is to make sure the money they invest will be repaid. Usually, independent third-party validation via market analysis is needed.

Though it’s not usually the case, this is something to consider for your firm when commissioning market research.When you get ready and need more capital to grow, market research can be a really useful instrument.

- Obtaining a loan

Let’s say you want to pursue the more official way and securing business loans.

If so, they’ll probably need a feasibility study or other unbiased market research to help confirm that your project has a chance of succeeding.

Since banks are businesses as well, they are interested in funding ventures where the lessee can confidently repay the loan amount.

- Eliminates risk

Essentially, the goal of market research is to lower risk. Could you successfully launch your firm without conducting any market research?

Yes. Are you more likely to succeed as a start-up if you used market research and the insightful data you gathered? Sure.

Consider the following product failures from the past ten years and the potential benefits of market research.

Typical Startup Obstacles: Market Analysis

Although there is a chance that new firms won’t succeed, there is also a great deal of hope that they will. Understanding the problems before you delve too far is crucial in this situation.

Drive Research conducted interviews with business owners and professionals regarding how to handle these problems for this section.

- Absence of sufficient content

To put it this way, there is never too much material for the website of a small business.

The basic cornerstone of your branding approach is content. You need a ton of resources on your website as a result.

Lack of content for your website can be the first sign of trouble for a startup business. Insufficient blog postings, poor landing page copy, and other issues may be the cause of this.

- The needs of the client or consumer are not being satisfied

The reason you are in business at all is because of your customers.

For this reason, prioritizing consumer needs is essential to the success of your brand. This not only strengthens your relationship with them but also aids in customer retention.

Consider this most recent statistic. When a business makes a mistake, up to 78% of customers will come back provided its customer care approach is sound.

When small business owners neglect this method, problems arise.

- Your Niche Is Too Broad

It is beneficial to start your business with a broad vision.

However, if that vision gets too wide, you risk managing too many services and losing focus on your main objectives. Though having ideas for your brand is a positive thing, small business and startup owners may find this difficult.

You must be aware of the risks involved when targeting a specialized market.

- Conduct research.

- Find your intended audience.

- Recognize your abilities: Are you able to serve this audience effectively?

- You don’t have enough clients/customers

Marks continues, “Our biggest challenge is to perform current projects and seek out new ones while simultaneously managing a large enough backlog of projects to keep their revenue stream growing.”

Marks has achieved this by diversifying his business by employing others to provide services while he concentrates on marketing.

It was harder to keep up this momentum many years ago when my father and I were just a one-man operation. Even while we can now accomplish this with the people we have, it remains a significant issue.

- There’s not enough time in the day

Startup business problems are frequently caused by owners’ lack of time to devote to all the moving components. As a result, your company may suffer—and most likely will.

Remember that it usually takes a new business between six months and a year to completely develop, so factor that into your overall schedule.

Make sure you’re prepared for the following before you start working on your business idea:

- More hours

- Looking into pertinent market trends

- Managing social media and a website while juggling several duties

Top Choices for Market Research for New Businesses

There are several choices available to you when it comes to conducting startup market research.

It’s critical to comprehend the benefits and drawbacks of various market research tools for startups. Whether you use a qualitative or quantitative method will depend on what you are attempting to learn.

- Online surveys

The best return on investment for a startup, in my opinion, is to conduct a concept test through an online poll.

You can obtain a large number of replies and a statistically significant sample using online surveys to inform your business model, marketing, and strategy decisions.

You may also break down the data by demographics using the large data set to have a deeper understanding of the factors influencing concept attractiveness and buy intent.

You can trust that the data is of the greatest caliber because we only use the best responders for our online surveys.

Online surveys can be conducted fast, cheaply, and efficiently—all of which are essential for a company. New product demand surveys, one of the most fundamental forms of startup marketing research, are adaptable and applicable to any sector.

- Studies on feasibility

Generally speaking, a development project or brick and mortar notion would be the most suitable for this multifaceted undertaking.

An examination of the market using Census data and 5-year projections is one of the main elements of a market research feasibility study. This helps you determine the direction of the market (i.e., is your target audience expanding or contracting).

Along with an audience survey, a competitive evaluation of competing companies and items in your category is also provided. Companies that do feasibility studies have a proprietary method that they use to assist you in determining whether your new idea is feasible.

- Market evaluations

All secondary research or desk research is used in a market study to produce information for you. This is a part of a comprehensive feasibility study.

It focuses on Census statistics and freely accessible materials and publications about the subject. Again, you are not gathering any new information when conducting secondary research, such as a market study. It’s data that’s readily available online.

The drawback is that while this is frequently quick and easy to do, it might not be as pertinent to your startup idea as a specially designed survey with pertinent and extremely targeted questions.

- Competitive evaluations

This is an additional section of the previously described entire feasibility study.

To identify gaps where your concept might be able to differentiate itself, you must conduct a thorough analysis of your main competitors’ pricing, product availability, major differentiators, and other data points.

- Comprehensive interviews (IDIs)

You have these more extended, in-depth discussions with the participants. Potential clients, industry subject matter experts, and other stakeholders may be among the attendees. These are typically phone calls or Zoom chats that last between thirty and sixty minutes.

A third-party research company can assist with participant recruitment, scheduling, and even conversational moderating.

Furthermore, if you are dipping your toes into the startup world and want to delve further into conversations, IDIs are frequently an excellent place to start.

The Process for Market Research Project

- Specify your goals.

- Start of

- Plan, Create, Start Data Gathering

- Quality assurances

- Evaluation

- Compiling reports

- Consultations

- Evaluate